What Assets Avoid Probate—And Which May Still Be Taxed

When someone passes away, their loved ones are often left sorting through not only emotions but also paperwork, legal terms, and financial decisions. One of the most common questions I hear is:

👉 “Does this asset have to go through probate?”

The answer isn’t always simple—because while some assets avoid probate, they may still be taxable. And as an executor or family member, it’s important to know who is responsible for covering those taxes.

This guide breaks it down in plain language so you can feel clear and confident moving forward.

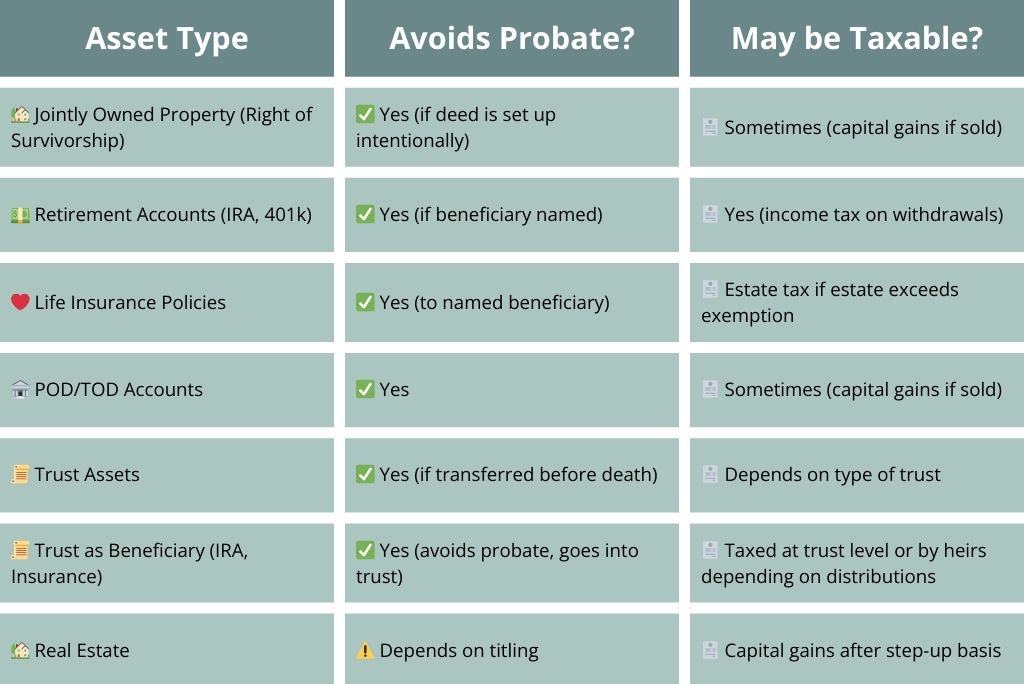

Assets That Avoid Probate

Some assets come with built-in instructions that allow them to transfer directly to heirs. These typically bypass probate:

-

Jointly owned property with right of survivorship – This must be intentionally set up on the deed. It is not the default in most states. When established correctly, the property passes directly to the surviving owner.

-

Retirement accounts (401k, IRA, Roth IRA) – If a beneficiary is listed, the account transfers directly to them.

-

Life insurance policies – Proceeds are paid directly to the named beneficiaries.

-

Payable-on-Death (POD) and Transfer-on-Death (TOD) accounts – Bank or investment accounts with a designated recipient.

-

Trust assets – Anything correctly transferred into a revocable living trust before death.

-

Accounts naming a trust as beneficiary – If a trust (rather than an individual) is listed as the beneficiary of an account or life insurance policy, the proceeds go into the trust and are then distributed according to the trust terms. This still avoids probate, but it adds trustee responsibilities and may have different tax treatment depending on the type of trust and how quickly distributions are made.

⚠️ Important note: If no beneficiary is named—or if the beneficiary has already passed away—those assets may end up back in probate.

Assets That May Still Be Taxed

Just because an asset avoids probate doesn’t mean it avoids taxes. Here are some common situations where taxes still come into play:

-

Retirement accounts – Heirs usually owe income tax on withdrawals (except for Roth IRAs if certain rules are met). If a trust is the beneficiary, the tax rules can be more complex. Distributions may be accelerated depending on the trust type, and the trust itself may be responsible for taxes before distributing to heirs.

-

Investment accounts – A TOD account may skip probate, but capital gains tax can apply when investments are sold.

-

Life insurance – Payouts are generally income tax–free, but if a trust is named as beneficiary, the funds may be considered part of the trust and could impact estate tax planning.

-

Real estate – Inherited property receives a step-up in basis (resetting its taxable value to the date of death), but selling it can still trigger capital gains.

-

Large estates – While rare, estates above the federal exemption ($13.61M in 2024, adjusted annually) may face federal estate tax. Some states also levy their own estate or inheritance taxes at much lower thresholds.

Who Pays the Taxes?

This is where executors and trustees often feel the weight of responsibility. Here’s how it usually works:

-

The Estate pays first:

-

Final income taxes for the deceased

-

Estate taxes (if applicable)

-

Outstanding property taxes or debts

-

-

Beneficiaries pay when:

-

They take distributions from inherited retirement accounts

-

They sell inherited assets and realize gains

-

-

Trustees may pay when:

-

A trust is the named beneficiary and receives retirement account or insurance proceeds. In that case, the trust may owe taxes before distributing funds.

-

-

The Executor is personally responsible for ensuring taxes are filed and paid before distributing assets. If assets are distributed too soon and taxes go unpaid, the executor may be held liable.

The Bottom Line

Probate and taxes are two different issues. An asset can avoid probate and still carry tax consequences. And when a trust is named as a beneficiary, the path may be smoother for heirs but more complex for the trustee in terms of taxes and administration.

If you’re an executor or trustee, the best thing you can do is:

-

Get organized early

-

Double-check beneficiaries and titling

-

Consult trusted professionals for tax and legal guidance

You don’t have to carry this alone. With clarity, communication, and the right support, you can protect both your loved one’s legacy and your peace of mind.